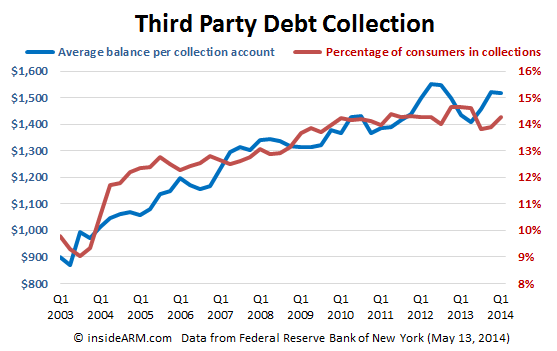

The percentage of Americans with at least one account in the third party debt collection system jumped to 14.3 percent in the first quarter of 2014, according to a report released Tuesday by the Federal Reserve Bank of New York.

In the fourth quarter of 2013, the measure stood at 13.8 percent. But the figure from Q1 2014 is still below the all-time high of 14.6 percent set in the first quarter of 2013.

The Federal Reserve Bank of New York’s (FRBNY) Quarterly Report on Household Debt and Credit measures third party debt collection activity – that is, collections not handled by the original creditor – as the percentage of consumers with at least one collection file on their credit report in the past 12 months. The report notes that only a small proportion of collections are related to credit accounts, with the majority of collection actions being associated with medical bills and utility bills.

The report also measures the dollar amount per collection account. That figure fell slightly in the first quarter of 2014 to $1,518 from $1,520 in the previous quarter.

The FRBNY Consumer Credit Panel consists of detailed Equifax credit-report data on a nationally representative 5 percent random sample of all individuals with a Social Security number and a credit report (usually aged 19 and over). FRBNY also samples all other individuals living at the same address as the primary sample members, allowing it to track household-level credit and debt for a random sample of U.S. households. The resulting database includes approximately 40 million individuals in each quarter.

Aggregate consumer debt increased in the first quarter by $129 billion, marking the first time aggregate debt has grown for three consecutive quarters since Q3 2008. As of March 31, 2014, total consumer indebtedness was $11.65 trillion, up by 1.1 percent from its level in the fourth quarter of 2013. The four quarters ending on March 31, 2014 registered the largest increase ($419 billion or 3.7 percent) in total debt outstanding since late 2008. Nonetheless, overall consumer debt still remains 8.1 percent below its Q3 2008 peak of $12.68 trillion.

Mortgages, the largest component of household debt, increased 1.4 percent during the first quarter. Mortgage balances shown on consumer credit reports stand at $8.17 trillion, up by $116 billion from their level in the fourth quarter.

Non-housing debt balances increased by 1.4 percent, with gains of $12 billion in auto loan balances and $31billion in student loan balances only partially offset by declines of $24 billion in credit card balances and $3 billion in other non-housing balances.

Delinquency rates improved for most loan types in the first three months of 2014. As of March 31, 6.6 percent of outstanding debt was in some stage of delinquency, compared with 7.1 percent in 2013Q4. About $770 billion of debt is delinquent, with $560 billion seriously delinquent (at least 90 days late or “severely derogatory”).

![[Image by creator from ]](/media/images/patrick-lunsford.2e16d0ba.fill-500x500.jpg)

![the word regulation in a stylized dictionary [Image by creator from ]](/media/images/Credit_Report_Disputes.max-80x80.png)

![Cover image for New Agent Onboarding Manuals resource [Image by creator from insideARM]](/media/images/New_Agent_Onboarding_Manuals.max-80x80_3iYA1XV.png)

![[Image by creator from ]](/media/images/Collections_Staffing_Full_Cover_Thumbnail.max-80x80.jpg)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![[Image by creator from ]](/media/images/Skit_Banner_.max-80x80.jpg)

![Whitepaper cover reads: Navigating Collections Licensing: How to Reduce Financial, Legal, and Regulatory Exposure w/ Cornerstone company logo [Image by creator from ]](/media/images/Navigating_Collections_Licensing_How_to_Reduce.max-80x80.png)