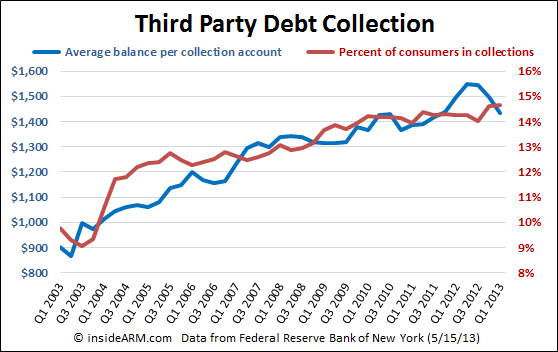

For the second straight quarter, the percentage of Americans with at least one account in the third party debt collection system hit an all-time high in the first three months of 2013. Close to 15 percent of consumers have an account being worked by debt collectors.

The Federal Reserve Bank of New York (FRBNY) Tuesday published its Quarterly Report on Household Debt and Credit for the First Quarter of 2013. The FRBNY noted that 14.64 percent of Americans had at least one account on their credit reports furnished by third party debt collection agencies, and all-time high. The figure was up slightly from the fourth quarter of 2012, which set a then-record 14.63 percent.

The average balance of those accounts in collection, however, is dropping rapidly. In the first quarter, the average balance of accounts in collection was $1,433, down from $1,499 in the previous quarter and well below the peak average of $1,550 in the second quarter of 2012.

The Quarterly Report on Household Debt and Credit is based on data from the New York Fed’s Consumer Credit Panel, a nationally representative random sample drawn from Equifax credit report data. In the notes for the report, the FRBNY says that “only a small proportion of collections are related to credit accounts with the majority of collection actions being associated with medical bills and utility bills.”

In Q1 2013 total household indebtedness fell to $11.23 trillion, one percent lower than the previous quarter and considerably below the peak of $12.68 trillion in Q3 2008.

Delinquency rates improved across the board: mortgages (5.4 percent from 5.6 percent), HELOC (3.2 percent from 3.5 percent), auto loans (3.9 percent from 4.0 percent), credit cards (10.2 percent from 10.6 percent) and student loans(11.2 percent from 11.7 percent). The overall 90+ day delinquency rate dropped from 6.3 percent to 6.0 percent this quarter, below the 8.7 percent peak from three years ago.

“After a temporary deceleration in the previous quarter, the data suggest that household deleveraging has resumed its previous trajectory,” said Wilbert van der Klaauw, senior vice president and economist at the New York Fed. “We’ll look to see if this pace of debt reduction and delinquency improvements will persist in upcoming quarters.”

Other highlights from the report include:

- Outstanding student loan debt increased $20 billion to $986 billion.

- Total mortgage debt decreased to $7.93 trillion from $8.03 trillion.

- Auto loans increased $11 billion to $794 billion.

- Credit card balances decreased $19 billion to $660 billion.

- HELOC balances fell $11 billion to $552 billion.

- Mortgage originations rose for the sixth consecutive quarter, to $577 billion.

- 184,000 individuals had new foreclosure notations added to their credit reports, down 12.5 percent from the previous quarter, the fourth consecutive quarterly decline.

![[Image by creator from ]](/media/images/patrick-lunsford.2e16d0ba.fill-500x500.jpg)

![the word regulation in a stylized dictionary [Image by creator from ]](/media/images/Credit_Report_Disputes.max-80x80.png)

![Cover image for New Agent Onboarding Manuals resource [Image by creator from insideARM]](/media/images/New_Agent_Onboarding_Manuals.max-80x80_3iYA1XV.png)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![[Image by creator from ]](/media/images/Skit_Banner_.max-80x80.jpg)

![Whitepaper cover reads: Navigating Collections Licensing: How to Reduce Financial, Legal, and Regulatory Exposure w/ Cornerstone company logo [Image by creator from ]](/media/images/Navigating_Collections_Licensing_How_to_Reduce.max-80x80.png)

![Whitepaper cover text reads: A New Kind of Collections Strategy: Empowering Lenders Amid a Shifting Economic Landscape [Image by creator from ]](/media/images/January_White_Paper_Cover_7-23.max-80x80.png)