Last year, LexisNexis launched Banko Events Montoring, a solution that automates the process of monitoring bankruptcy events and helps collections organizations improve efficiency, reduce cost and identify new sources of revenue.

LexisNexis® Banko® Events Monitoring tracks 588 events in the lifecycle of a bankruptcy. Clients can choose which events to monitor and on which type of filing (Chapter 7 or 13). Instead of manually searching court records services, organizations can be automatically updated when each event occurs. This helps with the most important aspects of bankruptcy management: timing. If you act too quickly on an account, you can run into legal trouble (like with Automatic Stay). If you’re too slow, you risk losing opportunities to recover debt.

Over the past year, clients have been using the product in batch. When a pre-selected event occurred, users were updated in a much timelier manner than through the traditional method: snail mail. This has worked great for most. But we learned that after being notified of an event, some clients still found it necessary to access a bankruptcy docket through the PACER system to get an idea of what happened before that event and what was going to happen next.

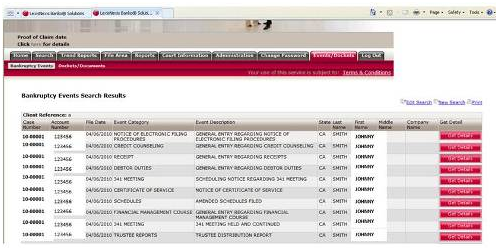

So we created the LexisNexis Recreated Docket, an online reconstruction of each bankruptcy case’s docket, available through a simple search on the Banko web site. Now, instead of searching a court docket and paying the PACER charges for each downloaded page, an Events Monitoring client can get all of the event s that display on a docket free of charge.

In addition to the Recreated Docket, we also included additional online functionality in this latest release. A client can now recreate their Banko spreadsheet online and link to relevant events within the web interface, saving time and hassle.

The main advantage of the new Docket and online functionality is the ability to view related motions and events for a reported event. When a pre-selected event occurs in a bankruptcy – the rejection of a Chapter 13 plan, for example – the court often references a previous event in its notification, in this example, the initial filing of the Chapter 13 plan. But for clients with large volumes working in batch, it can be difficult to go back and find that referenced plan, sending them to PACER to further investigate.

With the online delivery of LexisNexis Recreated Docket, not only can clients know that a Chapter 13 plan has been rejected, but they can view that plan in total and get a reasonable estimation – based on the filing’s previous timelines – of when an amended plan might be filed.

The intent is to make Banko a full circle solution where clients can manage their bankruptcy cases all in one place.

Linda Straub Jones is a Collections Solutions Product Consultant at LexisNexis Risk Solutions.

Banko® is a consumer reporting agency product provided by LexisNexis Risk Solutions and is fully compliant with the Fair Credit Reporting Act, 15 U.S.C. 1681, et seq.

Due to the nature of the origin of public record information, the public records and commercially available data sources used in reports may contain errors. Source data is sometimes reported or entered inaccurately, processed poorly or incorrectly, and is generally not free from defect. This product or service aggregates and reports data, as provided by the public records and commercially available data sources, and is not the source of the data, nor is it a comprehensive compilation of the data. Before relying on any data, it should be independently verified.

![[Image by creator from ]](/media/images/lindajones.2e16d0ba.fill-500x500.jpg)

![the word regulation in a stylized dictionary [Image by creator from ]](/media/images/Credit_Report_Disputes.max-80x80.png)

![Cover image for New Agent Onboarding Manuals resource [Image by creator from insideARM]](/media/images/New_Agent_Onboarding_Manuals.max-80x80_3iYA1XV.png)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![[Image by creator from ]](/media/images/Skit_Banner_.max-80x80.jpg)

![Whitepaper cover reads: Navigating Collections Licensing: How to Reduce Financial, Legal, and Regulatory Exposure w/ Cornerstone company logo [Image by creator from ]](/media/images/Navigating_Collections_Licensing_How_to_Reduce.max-80x80.png)

![Whitepaper cover text reads: A New Kind of Collections Strategy: Empowering Lenders Amid a Shifting Economic Landscape [Image by creator from ]](/media/images/January_White_Paper_Cover_7-23.max-80x80.png)