The U.S. health insurance market is on the cusp of change: four of the five largest health insurance providers are attempting to merge and embrace economies of scale, and bad debt is on the rise.

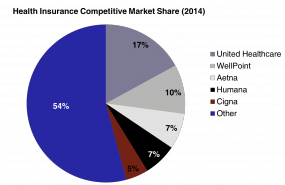

Although the health insurance market isn’t as consolidated as the cable and telecommunications industries, the top five health insurance companies currently account for 46% of the market share. The FTC and Congress are monitoring the impact these any mergers would have on competitive balance and – in turn – the consumer. Mergers aside, current growth rates have these five players accounting for 54% of the market share by 2019.

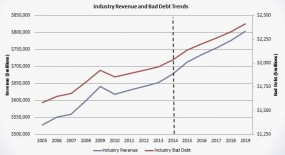

Using historical industry data, Kaulkin Ginsberg projects the total revenue and bad debt levels for the health insurance market through 2019 in the chart below. We chose to keep our outlook conservative by limiting the growth in bad debt as a percentage of total revenue to current estimates.

Analyzing our chart, we gather two very important pieces of information:

- Historically – and into the future – insurance companies maintain a very low bad debt level of approximately 0.30%. Although this bad debt level has held constant in the past, it’s expected to rise slightly over the next three to five years.

- A 0.30% bad debt level sounds low, but it’s important to keep in mind the total value of this bad debt. In 2014, 0.30% of write-offs accounted for more than $2 billion in bad debt, and 2019 is conservatively estimated to account for more than $2.4 billion in bad debt.

Normally insurance providers wouldn’t insure individuals deemed “risky” or “too costly.” However, the launch of Obamacare mandated insurance for all U.S. citizens and increased the cost for insurers by removing their right to deny coverage. The result has been a significant rise in bad debt that is outpacing the growth of net income, and a greater need for outsourced ARM services.

We are happy to talk with you about growth opportunities within the healthcare market or another sector. To schedule a confidential discussion of your business needs, please contact us at hq@kaulkin.com. For more information about the healthcare industry and for access to our exclusive KG Prime archives, please contact Danielle Dredger at ddredger@kaulkin.com.

![Company logo for Kaulkin Ginsberg [Image by creator from Kaulkin Ginsberg]](/media/images/kgc-logo.2e16d0ba.fill-500x500.jpg)

![the word regulation in a stylized dictionary [Image by creator from ]](/media/images/Credit_Report_Disputes.max-80x80.png)

![Cover image for New Agent Onboarding Manuals resource [Image by creator from insideARM]](/media/images/New_Agent_Onboarding_Manuals.max-80x80_3iYA1XV.png)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![[Image by creator from ]](/media/images/Skit_Banner_.max-80x80.jpg)

![Whitepaper cover reads: Navigating Collections Licensing: How to Reduce Financial, Legal, and Regulatory Exposure w/ Cornerstone company logo [Image by creator from ]](/media/images/Navigating_Collections_Licensing_How_to_Reduce.max-80x80.png)

![Whitepaper cover text reads: A New Kind of Collections Strategy: Empowering Lenders Amid a Shifting Economic Landscape [Image by creator from ]](/media/images/January_White_Paper_Cover_7-23.max-80x80.png)