Emotional intelligence and making connections are at the heart of empathy. An empathetic approach to debt collection relies on the ability to recognize customer triggers. We teach this as having the awareness to understand someone’s emotions. Once you understand the emotions, you adapt your communications style to make a connection.

A stepped approach to teaching empathy includes tapping into behaviors, using a pragmatic call approach and monitoring calls for continuous improvement. Here are the three elements of training for an empathetic approach to collections:

- Success profiles and behaviors

- Call modeling to recognize triggers and investigate root cause

- Practice and ongoing coaching

"But being fully empathetic also means being able to regulate your own emotional responses, care about how others feel, understand what they need and respect differing views. —BBC Science Focus Magazine"

Success Profiles and Associated Behaviors Drive Connections

Adapting a conversation based on customer emotions is far easier when face-to-face. Phone agents don’t have the luxury of seeing non-verbal cues.

Start with success profiles and associated behaviors necessary to recognize the need for empathy. Once you understand the competencies your team needs to possess, you can teach those behaviors.

Sample Success Profiles and Behaviors

- Customer Understanding (Listens intently to ensure full understanding of Customer needs) - Understands what the ‘right’ questions are and when digging deeper is needed to achieve the information you need to provide the best solution.

- Effective Communication (Communicates with appropriate emotion with every Customer) - Can match the Customer’s communication level (e.g., pacing, calming tone if upset, volume of speech if they cannot hear you).

- Business Acumen (Demonstrates excellent knowledge in all aspects of the business) - Demonstrates a clear understanding of the tools and programs to help the Customer (qualification, escalation, paperwork accuracy).

- Balancing Customer and Client Needs (Anticipates the Customer’s needs with what the client can offer) -Proactively looks for ways to match the Customers’ needs with offers/programs that can help and respectfully communicating when we cannot help.

- Critical Thinking (Ability to review Customer data, understand policies/procedures and deploy sound judgement to help) - Thinks things through thoroughly and uses common sense to reach workable solutions that balance efficiency and exceptional Customer experience.

- Conflict Management (Takes action to resolve conflict)- Recognizes unfavorable Customer tone/speech patterns and adapts to try to avoid potential escalation.

Using Success Profiles with Your Team

Identify the success profiles and corresponding behaviors that your team requires and then assess individuals based on who best meets the profile. Not every employee will have every item listed but they can be taught behaviors. Teach agents how to recognize when empathy is needed by recognizing how people sound and what they say.

[article_ad]

Finding an Empathetic Approach in a Call Model

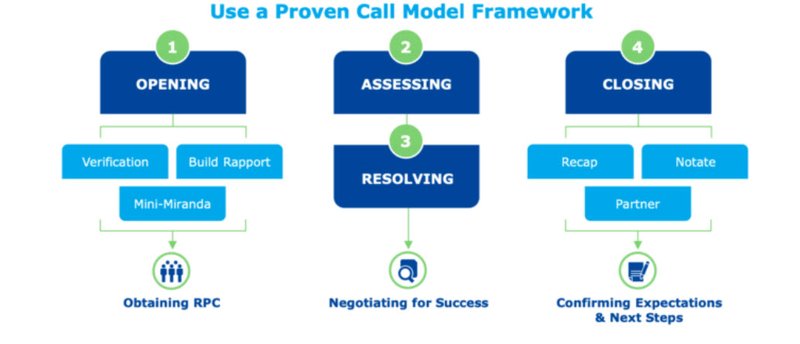

The four components of the call model framework balances assessment of the customer’s financial situation—which is incredibly important—with providing sustainable solutions. The framework provides a consistent customer experience and effective agent habits throughout the call.

"The call model flow ensures that administrative elements are handled, but also that the call has an appropriate flow to cover all those elements. It's all about the balance: Achieving the right balance of empathy, regulatory and technical execution of a call. Remember, everyone wants a piece of your call: QA, regulators and customers."

Four Components of a Call Model

- Opening – We teach repetitive behavior ensuring that we’re verifying the customer, talking to the right party, reading the mini-Miranda and building rapport with the customer through scripting and role playing. This is where you acknowledge the caller’s situation.

- Assessing – We teach here to understand the reason for delinquency and discover how much the customer can pay. You assess the customer’s financial situation by asking open-ended questions until you understand the customer’s ability, stability and willingness to pay. This activity uses root cause analysis. The key to communication here is to avoid duplicative questions and a condescending tone.

- Resolving – Here we explain how to match the customer’s circumstances with the available options (customized to your organization) such as payment treatments or payment programs.

- Closing – We teach the importance of how you wrap up the call. Confirm the customer’s understanding of next steps and set expectations for what the customer is to do and what your company will do. It is important here to thank the customer, even if only for their time and making them feel valued as they leave the conversation.

Throughout the call model, you can find opportunities to recognize customer triggers via the tone, pacing, word choice and level of engagement in the conversation. This is where communications skills become even more important.

Building Communications Skills for the Call Model

While there are four specific stages to the call model, calls cannot be fully scripted. Agents must learn how to adapt during the call based on the customer’s cues.

We do this with tone, pace, avoiding negative language, and demonstrating active listening by reflecting what you’ve heard. Listening intently and saying “I understand” authentically can go a long way to building trust with the customer.

Effective Communication Techniques:

- Maintain a tone that is calm and confident. Keep your pace steady and not rushed.

- Be selective with word choice: Use “I” and not “you” when speaking to customers. Some suggested phrases are: (a) I have helped others in a similar situation… (b)I understand…(c) I know it can be upsetting when…

- Use open ended questions to gather information. For example: “How are you handling your other bills?” or “How did that impact your ability to pay?”

- Keep control of the call. This requires an ability to avoid getting emotional, using silence effectively and avoiding judgmental tone or words.

Training and Monitoring for Success

Part of teaching empathy requires an understanding that this is not a ‘one and done’ endeavor. Using our methodology, we start by teaching why empathy is important. Then we listen to examples of successful calls that are managed correctly with an agent showing empathy. Finally, we have the team practice and take part in role play using actual customer scenarios.

We suggest you identify the top call types and develop realistic examples for each scenario to practice with your team. Common scenarios can be modeled for role play and training to the specific call types. Below are five scenarios we often leverage in our training:

- Medical Hardship

- Death / Bereavement

- Incarcerated Borrower

- Fire in the Home

- Homeless Borrower

Listening to calls and providing feedback is crucial to sustainability. Though every customer situation is different, similarities occur in recognizing when empathy is needed and how to make a connection with the customer. Here you can identify when calls are handled the right way and share those instances with the team to model the appropriate behaviors.

Expectations should be assigned for every call. That way, each person being trained has standard guidelines based on success profiles. Each agent’s handling of a scenario can be assessed during training, practice and role play. We recommend intensive coaching after the training because coaching cements learning and supports sustainability for the long term.

While you cannot script empathy, you can have a guide until the team can get there on their own—just like training wheels. Each of the elements outlined above help develop empathetic behaviors and the ability to listen and communicate with empathy. We’ve seen this work to improve collections rates and customer satisfaction scores.

![Kristin Stolp [Image by creator from ]](/media/images/Kristin_Stolp.2e16d0ba.fill-500x500.jpg)

![the word regulation in a stylized dictionary [Image by creator from ]](/media/images/Credit_Report_Disputes.max-80x80.png)

![Cover image for New Agent Onboarding Manuals resource [Image by creator from insideARM]](/media/images/New_Agent_Onboarding_Manuals.max-80x80_3iYA1XV.png)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![[Image by creator from ]](/media/images/Skit_Banner_.max-80x80.jpg)

![Whitepaper cover reads: Navigating Collections Licensing: How to Reduce Financial, Legal, and Regulatory Exposure w/ Cornerstone company logo [Image by creator from ]](/media/images/Navigating_Collections_Licensing_How_to_Reduce.max-80x80.png)

![Whitepaper cover text reads: A New Kind of Collections Strategy: Empowering Lenders Amid a Shifting Economic Landscape [Image by creator from ]](/media/images/January_White_Paper_Cover_7-23.max-80x80.png)