Optimizing your collection strategy is always critical, but getting things right can be especially pressing when faced with economic uncertainty and an increase in delinquencies. A data-driven prioritization strategy can help improve recovery rates while minimizing lost time and costs.

With Collection Triggers℠, you can better monitor and prioritize accounts to level up your collection efforts.

Challenges facing agencies and debt collectors

It's important to recognize the challenges that agencies and debt collectors often struggle with. These include:

- Managing their workforce: Dealing with an increased workload will be especially difficult for organizations that struggle to hire and retain staff.

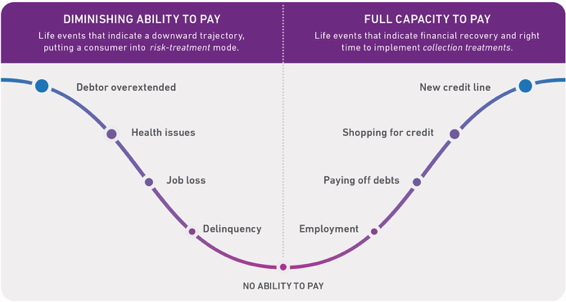

- Knowing who to contact: Traditional prioritization based on account age can be effective, but it isn't necessarily the best option. Ideally, you can accurately and quickly identify a consumer's ability to pay and offer appropriate treatment at the right time.

- Maintaining correct contact information: Text messaging and social media are giving collectors more options. But you still need to consider consumers' communication preferences and frequently confirm that you have the correct contact information.

- Reducing costs and improving operational efficiencies: You might be asked to do more with less. It's not an easy task, and you'll need to carefully think through which investments offer a solid return on investment.

Agencies and debt collectors are tackling these challenges in different ways. But it's clear that finding a solution that can improve recovery rates without increasing agents' workloads is important.

What is Collection Triggers℠?

Experian's Collection Triggers is an account monitoring tool that can be customized to notify you whenever there's a "triggering" event on an individual's credit profile.

Triggers can include new employment, new contact information or a new credit line. But they can also be more granular, such as separate triggers for different positive improvements (e.g., a paid loan, paid auto loan or an account going from 60 or 120 days past due to current).

How can Collection Triggers improve the collections process?

You can use Collection Triggers throughout the recovery process — from early-stage delinquencies to post-judgment accounts — to strategically prioritize your outreach and increase profitability.

Having specific triggers is important, as you can define the triggers and monitoring criteria for your accounts. Experian can offer guidance on the best-fit triggers based on previous collectors' experiences.

For example, we've found that payment-related triggers can be highly effective when collecting on bankcard accounts. These include when a consumer pays a different collection account, pays a charged-off account or brings an account current after being 120 to 180 days delinquent.

Bankcard is just one example — triggers are helpful in collecting on personal loans, medical debt, retail, and other trades. Such “positive improvements" indicate that the consumer may have a willingness to pay and available resources. Timing may be ideal to reach out to them about other outstanding obligations, as their financial situation has likely improved since your last contact attempt.

Triggers on contact data can also put a spotlight on accounts with a new phone number, address or employer. And the use of Collection Triggers offers a clear return on investment because it prompts collectors to take action on accounts that would otherwise go unworked. The passive monitoring of triggers also removes the need to repeatedly skip trace older accounts.

Experian helps collectors modernize and optimize operations

Collection Triggers is an effective, flexible and cost-efficient solution on its own. There's no upfront cost for monitoring — you only pay when a trigger event you choose occurs. By taking the guesswork out of managing your portfolio, you can improve right-party contact rates and deploy a powerful, efficient collection strategy.

The recovery process is time-consuming and expensive. Using Collection Triggers can help avoid common pitfalls when managing your portfolio and serve as a best practice for handling aged inventory. Relevant events will be pushed to you in real time for accounts you want monitored and you only pay for what you use.

Contrast this with the alternative, which repeatedly processes the same files in an exhaustive search for attributes on all your accounts every month. This cumbersome approach involves pulling in reams of data while searching for nuggets of interest. You pay for every search, even when the results provide no benefit to you.

Experian also offers additional solutions for collectors. For instance, our skip tracing tools draw from proprietary credit data and alternative data on over 245 million consumers, including unlisted phone numbers and rental payments data, to verify and update consumers' contact information.

Or leverage the latest analytical approaches that segment and identify consumers who are likely to self-cure, require a reminder or are unable to pay. We also help agencies and collectors use machine learning and artificial intelligence to automate collections, enhance customer satisfaction and streamline processes.

Contact Experian to learn more about Collection Triggers and our debt recovery solutions.

[article_ad]

![[Image by creator from ]](/media/images/2022-experian-logo_author.e7757293.fill-500x500.png)

![[Image by creator from ]](/media/images/Finvi_Tech_Trends_Whitepaper.max-80x80.png)

![[Image by creator from ]](/media/images/Collections_Staffing_Full_Cover_Thumbnail.max-80x80.jpg)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![[Image by creator from ]](/media/images/Skit_Banner_.max-80x80.jpg)