If your business and collection partners aren’t utilizing email in your debt recovery strategy, you’re leaving vital engagement opportunities (and potential collections) on the table. There are plenty of reasons why digital communications are the way to go, but reaching out through email is especially important in collections.

Surveys show that 59.5% of consumers prefer email as their first choice for communication, and 14% of bill-payers prioritize payments that offer lower-friction payment experiences, which increases to 23% for millennials specifically. Considering this, it shouldn’t come as a surprise that courts have actually ruled that “an email is less intrusive than a phone call” for debt collection.

But what makes a successful email program when it comes to connecting with delinquent accounts? Whether your business is handling collections in-house or are looking at working with a third party, your operations should be confident that you have these core components covered.

Core Components for a Successful Email Program

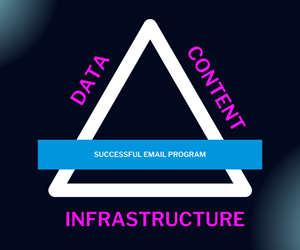

While adding email into the communication channel mix is critical, it is the set up, execution, and continued optimization of that email program that can actually make a difference when it comes to consumer engagement. There are many elements to a successful email strategy, but here are three of the core components that we’ll focus on:

Infrastructure, Data, and Content

All 3 are required for a successful email program—each one relies on the other two to create a high performing program.

Let’s take a look at why each of these is important and the risks that can occur without each component in place.

Infrastructure

The infrastructure an email program is built on has many components itself: Mail Servers, Mailbox Providers, Internet Service Providers (ISPs), Email service providers (ESPs), and more. How these components are set up and work together influences sender reputation, which in turn influences email delivery rates. You can learn more about these different pieces in our blog focusing on the The (Hidden) Anatomy of Email.

While infrastructure can admittedly be complex, the risks your operation runs without a sound infrastructure are clear and quite consequential, including having your emails blocked, deferred or delayed delivery, or winding up lost in the recipient’s spam folder.

Data

In today’s digital world, data is everywhere—but how you harness that data can make or break your email program (and even get you into hot water if you or your collections partner are not following all the necessary compliance regulations around data privacy and protection). Understanding data helps intelligently influence an email program, especially when focusing on email engagement metrics such as:

- Opens

- Clicks

- Unsubscribes

- Spam complaints

- Hard Bounces

- Spam traps

But without quality data analyzed appropriately, your emails could result in consumer complaints, hard bounces, falling into spam traps, not to mention negatively impacting all the engagement metrics listed above.

Content

Solid infrastructure and reliable data are essential in any email program, but when it comes to debt collection, content can be the tipping point between a consumer committing to repayment or ignoring the outreach altogether—or even reporting your communications as spam or harassment.

From subject lines to your call-to-action (CTAs), sending the right message to your customers is crucial. Without compelling content you miss opportunities to capture consumers attention resulting in fewer opens, fewer clicks, or even pushing consumer perception in the wrong direction. If you lose your customers’ trust, you’re most likely going to lose the chance to recover their debt.

Successful Email Engagement Can Boost Debt Recovery

Studies have shown that engaging consumers through digital methods can increase resolution rates by as much as 25%. But if your digital efforts are missing any of the core components we just covered above, it doesn’t matter if your collection strategy includes email—your operations are going to be missing recovery opportunities.

![Cali Thompson [Image by creator from ]](/media/images/Cali_Thompson.2e16d0ba.fill-500x500.jpg)

![[Image by creator from ]](/media/images/Finvi_Tech_Trends_Whitepaper.max-80x80.png)

![[Image by creator from ]](/media/images/Collections_Staffing_Full_Cover_Thumbnail.max-80x80.jpg)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![[Image by creator from ]](/media/images/Skit_Banner_.max-80x80.jpg)