Those of us who have witnessed the frustration of consumers who have paid money to a debt settlement company only to find out their debt hasn’t actually been paid down may have wondered how the consumer got there. Were they tricked? Or did they understand what they were signing up for? A party to one of these agreements recently shared the complete process and unredacted debt settlement agreement with me. The fine print was shocking. Though this can only be directly tied to one debt settlement company, I suspect this agreement is not unique.

The 80-year-old consumer who entered into the agreement contacted the Debt Settlement Company (DSC) in the spring of 2023 after seeing an advertisement claiming the DSC could negotiate down his debts by 35%. To him, this seemed like a great deal! Within a few days, the DSC got the elderly consumer's signature by sending a mobile notary to meet him locally.

Though vague bullet points regarding the terms of the agreement were provided to him at signing along with more promises of reduced debt, he did not have the time at signing to read the fine print of the agreement. They say the devil is in the details, and this agreement is no exception. The fine print set up an arrangement entirely different than the verbal representations and bullet points provided to the elderly consumer.

The Agreement

Though the DSC promised attorney representation and reductions of at least 35% of his debt, here’s what the consumer actually signed up for:

The program is expensive, charges upfront fees, and puts consumers in a worse financial position than where they started

The agreement I reviewed showed that the Consumer’s total debt was over $110,000.00. The DSC was going to charge:

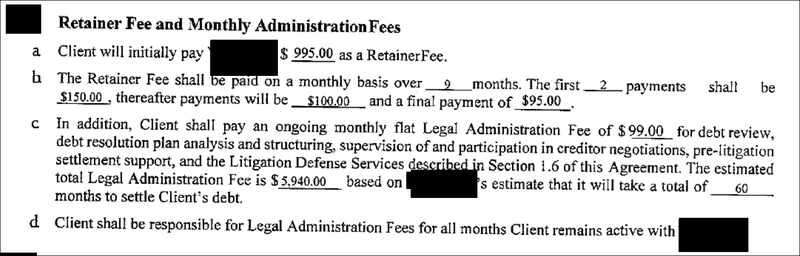

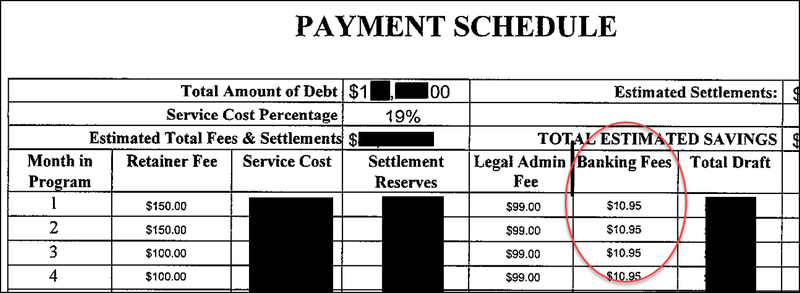

- An upfront retainer fee of $995.00

- Monthly Legal Administration fee -$99.00

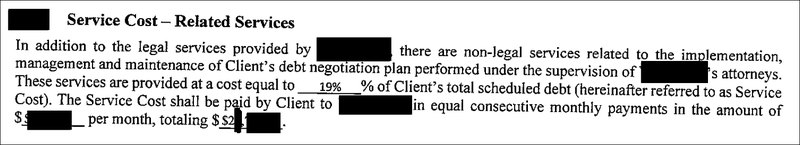

- Service costs of 19% of total debt - (= Greater than $20,000.00);

- a $10.95 banking fee, Which wasn’t disclosed until the payment schedule sheet of the contract; and

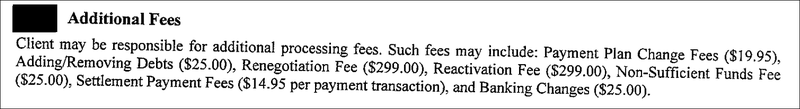

- other fees may also apply

The DSC contract required the consumer to pay more than $1,300/mo. to meet these amounts.

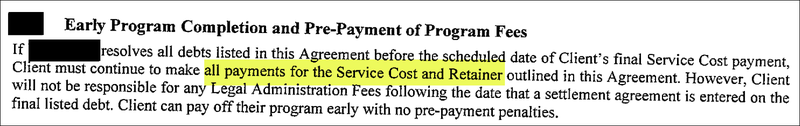

Though the DSC set a target settlement at 35% off of the Consumer’s debt, doing the math, at best, the retainer fee + monthly fees + service costs + monthly cost of maintaining the account means that their clients end up perhaps only slightly ahead of paying 100% of their debts. At worst, if the DSC keeps them in the program longer than the estimated amount of time, the consumer could ultimately pay more.

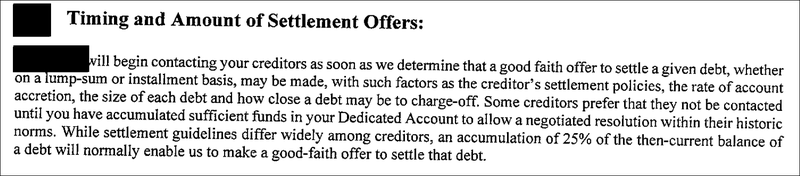

The DSC will not attempt to settle debts right away

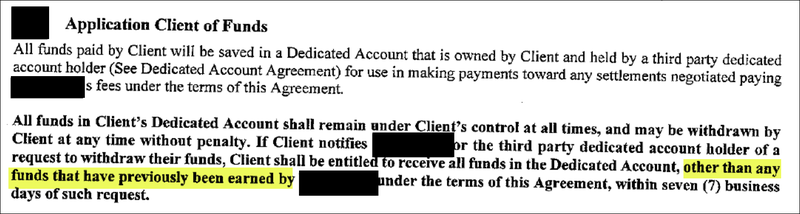

Further compounding the financial burden on the consumer, auto-drafting is required, yet the DSC will hold funds and not reach out to creditors until 25% of the balance is deposited in the bank account the DSC manages. Late fees and other charges will continue to accrue during this time. If the consumer terminates the agreement, the DSC will take funds it "earned" before returning anything to the client. Consumers are responsible for fees regardless of early settlement.

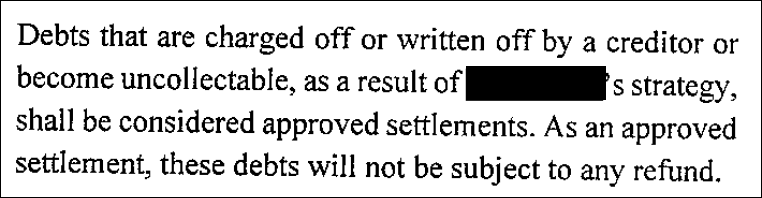

By holding funds and not communicating with creditors, the DSC forces charge-offs. Buried in the fine print, charged-off debts are considered approved settlements; DSC can settle however they want.

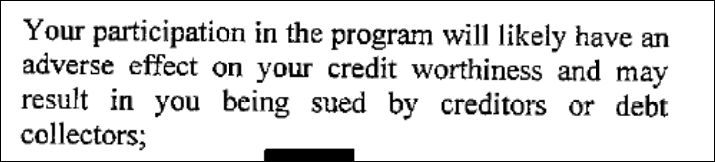

Finally, the DSC admits that this program will harm the Consumer’s credit and may result in lawsuits.

The Consumer is not represented by an attorney in the traditional sense of the word.

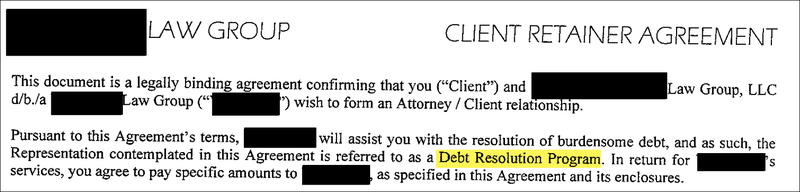

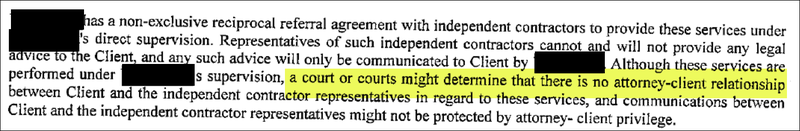

Though there is a law firm tied to the agreement, the agreement is titled as a "client retainer," and states in the opening paragraph that it forms an attorney/client relationship, a more careful review of the fine print shows the agreement is actually for a "Debt Resolution Program.” Driving this point home, further down in the agreement, the fine print says that the consumer doesn’t really have attorney representation and notifies the consumer that a court might find there is no attorney representation under the agreement.

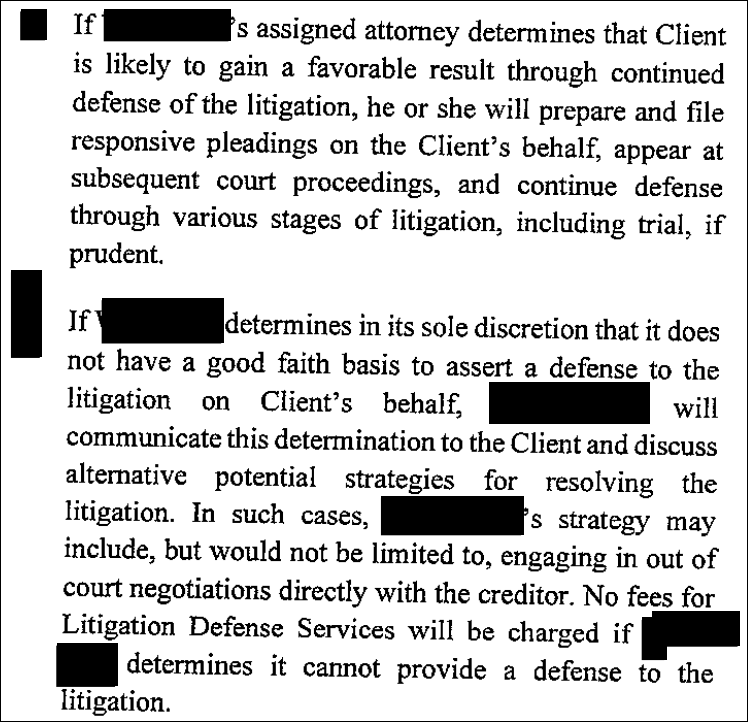

More importantly, despite holding itself out as a “Law Group” and implying to the consumer that attorneys would be handling the consumer’s debt and their "case," the fine print says the work will be performed by contracted parties, and the DSC will only defend lawsuits if it thinks it can gain a favorable result. In other words, despite thinking they are legally represented, the consumer will be on their own to defend a lawsuit if the DSC isn't interested in it.

Unlike an attorney, the DSC won’t handle phone calls about debts. The fine print says collection calls will continue and complicates the matter by prohibiting the consumer from discussing debts when contacted. An actual attorney would handle communications on behalf of their client.

A Call to Action:

Debt settlement agreements like the one highlighted above pose a real threat to consumers. They are particularly detrimental since the consumer thinks they are engaging with an entity that is there to help them. Though ARM industry participants have no control over debt settlement companies, there are two ways we can help eradicate these bad actors.

Inform regulators

The ARM industry has many contacts with regulators. When we learn about or get these agreements, we should send them to our contacts at the Consumer Financial Protection Bureau (CFPB) and the Federal Trade Commission (FTC). This is not to engage in a what-about-ism discussion but instead shows our collective continued dedication to making the debt collection landscape better for consumers. Though we can disagree with many of the CFPB's recent initiatives and the way they go about them, we can't pick up our ball and go home when it comes to consumer protection.

Enhancing our messaging to consumers

Unlike the villainous descriptors hurled our way, debt collectors are the pressure release valve between charge-off and litigation or bankruptcy. The debt collection industry provides consumers with options regarding their debt that they didn't know were available. Perhaps if more consumers knew that, they wouldn't feel the need to sign up with debt settlement companies that trick them into paying them under the guise of helping. We, collectively, can be louder about the benefit we provide consumers. Not just our critical role in the financial ecosystem but about the real, tangible benefits our industry provides those consumers who are trying to figure out how to get back on their feet.

![Missy Meggison [Image by creator from ]](/media/images/Missy_Meggison_8PYANpG.2e16d0ba.fill-500x500.png)

![[Image by creator from ]](/media/images/Collections_Staffing_Full_Cover_Thumbnail.max-80x80.jpg)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![[Image by creator from ]](/media/images/Skit_Banner_.max-80x80.jpg)

![Whitepaper cover reads: Navigating Collections Licensing: How to Reduce Financial, Legal, and Regulatory Exposure w/ Cornerstone company logo [Image by creator from ]](/media/images/Navigating_Collections_Licensing_How_to_Reduce.max-80x80.png)