Repayment programs are crucial in collections, but many fail. Here are the essential elements for a successful repayment program strategy and tips to enhance collections conversations to ensure the right program is chosen and completed.

For those of us in the collections industry, we are familiar with various terms referring to a customer’s commitment to pay. Whether it’s “plan,” “program,” “treatment,” or “arrangement,” we’re essentially discussing the same thing. For consistency in this article, we’ll refer to them as “programs.”

Repayment programs take center stage in every collector’s conversation with a customer. When meaningfully applied, these programs offer relief to the customer and certainty for the lender, yet many end up broken. So, what causes this breakdown? It boils down to two critical components: the suite of available program offerings, and the effectiveness of the conversation with the customer.

Both elements are equally important. Effective collections repayment program strategies start with a reasonable suite of available program offerings. While collections continues to shift to digital engagement, it’s vital to recognize the second critical component, the ongoing necessity for agent conversations, particularly for the most complex situations or financial hardships.

A Successful Collections Repayment Program Strategy has Multiple Payment Plan Options

Collectors and borrowers need options at their disposal to establish an effective program. If your program suite consists of a simple “payment plan” option, it’s a fair assumption that your program break rate and recidivism rate is high. Just like trying to escape a maze by only turning left is difficult and restricting (if not impossible); so too is trying to establish a reasonable and “keepable” program when there is only one option available.

“A program suite with one option is like trying to escape a maze by only turning left.”

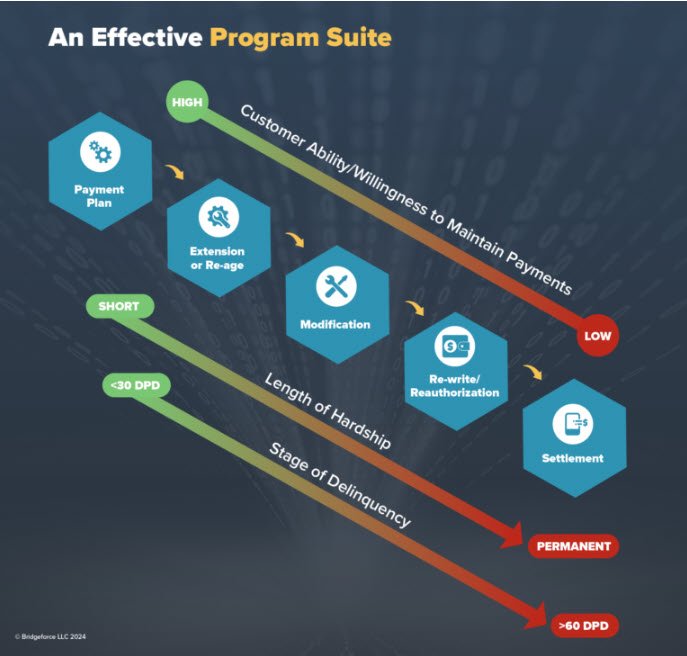

An effective and comprehensive program suite must address both short- and long-term hardships (i.e., <60 days or >60 days, respectively). It must also include programs suitable for customers with varying levels of willingness or ability to pay. And lastly, it must consider the current stage of delinquency of the account. An example of a program suite that accomplishes these key requirements is shown in the diagram below.

Avoid creating a complex, over-engineered program suite. Having too many options is as bad as having too few and may make it difficult to ultimately choose the appropriate program. Instead, aim to develop a program suite offering 3-5 options with easily evaluated, objective eligibility criteria. This approach will empower collectors to put customers in the best position to cure their delinquent account, and more importantly, remain current.

Three Key Conversation Components in Your Repayment Program

A successful collections conversation relies on three key components: (1) understanding the customer’s reason for delinquency and financial outlook by asking open-ended questions, (2) selecting the right program for right customer, and (3) confirming the program plan. If done well, they lead to selection and completion of a successful program. However, if the components lack detailed information, authenticity and empathy, they will likely fail. Customers prefer interacting with collectors who are genuine and empathetic, rather than sounding robotic and scripted, or giving the impression that they don’t care.

Empathy is Critical for Keeping Customers Around

In a study conducted by Lexop, a striking 32% of respondents blamed their negative past-due experiences on unsympathetic and rude agents. Shockingly, 71% of them considered switching to the competition as a result. Clearly, being empathetic in your communication is absolutely critical.

Use the following three conversation components to identify, establish and execute successful payment programs that don’t break.

1. Use Open-Ended, Probing Questions to Keep the Customer Talking

An engaged customer who responds with more than mere “Yes,” “No,” or single-word answers will help to identify the most appropriate program. It sounds simple, but many collectors overlook this approach. Agents must remember that it’s a “discussion,” not just a checklist to tick off. If the customer isn’t engaged, they may agree to payment programs that are not affordable for them.

Making it Real:

An example of what an unsuccessful collector might say to open the dialogue: “Can you make a payment today?”

An example of what a successful collector would say to open the dialogue: “I’m here to help in any way possible. Can you tell me a little about why you have fallen behind on your account? Then we can see about finding a program that works for you.”

2. Match the Right Program with the Customer’s Responses

Once the collector understands the customer’s situation (e.g., length of hardship, severity), they need to apply that information against their program matrix or hierarchy. If the program suite has been established as outlined earlier, it should be clear which option aligns best with the customer’s circumstances.

Not all delinquency situations fit into a neat and tidy box. So, collectors should be ready to review exceptional cases and know how to escalate a situation for further consideration.

Making it Real:

- Account is an auto loan

- Account is 35 days past due

- Customer missed 2 weeks of work due to an injury

- Customer is back to work and can maintain monthly payments but can’t pay 2 at once.

- Most appropriate program = 1 month extension + 1 scheduled payment (to remain current)

3. Recap and Confirm the Agreed Upon Program

While it sounds like a simple step, failing to complete this stage can have significant consequences. Customers should leave the conversation having just reiterated and confirmed their understanding of the commitment they are making. Many short-term programs will be simple, while longer-term or permanent programs (e.g., modification or settlement),) can involve multiple components. So, a customer’s understanding of their post-call responsibilities is crucial for program success.

The most successful programs are those that are repeated and reinforced in writing. If feasible, send a confirmation to the customer (preferably digitally), to eliminate any doubts or confusion regarding obligations.

From a collector’s perspective, documenting the program is equally vital. Since customers may interact with different agents in the future, thorough notes and appropriate system status codes on an account ensure that future collectors are well-informed, and the customers’ experience is seamless.

Making it Real:

- Collector talking points for recapping an extension:

- Confirm the customer’s email address

- A form will be emailed outlining the plan (if possible, signature)

- No fees are required to process the extension

- Work with customer to schedule the first payment in the program

- Send an email to the customer to outline the program, what they need to do, due dates for payments going forward, provide any auto-pay options and advise on self-service channels for future payments

- Ask the customer to confirm dates and payment amounts at the end of the conversation to ensure understanding

Finding success in repayment programs can fall on the communication skills of your agents. So, a significant portion of the Performance Suite emphasizes authentic and empathetic conversations, taught through interactive activities and role-playing exercises. This approach enables participants to practice effective communication habits outlined in this article.

![Andrew Domino [Image by creator from ]](/media/images/Andrew_Domino.2e16d0ba.fill-500x500.jpg)

![the word regulation in a stylized dictionary [Image by creator from ]](/media/images/Credit_Report_Disputes.max-80x80.png)

![Cover for Consumer Hardship: Policies & Procedures document packet with image of man wearing jeans showing his empty pockets [Image by creator insideARM from ]](/media/images/Product_Thumbnail_1.max-80x80_x5rMzmy.png)

![[Image by creator from ]](/media/images/Finvi_Tech_Trends_Whitepaper.max-80x80.png)

![[Image by creator from ]](/media/images/Collections_Staffing_Full_Cover_Thumbnail.max-80x80.jpg)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![[Image by creator from ]](/media/images/Skit_Banner_.max-80x80.jpg)