Last month, Mark Neeb and I opened the general session of the ACA International conference by presenting on the state of the debt collection industry.

For those of you who don’t know Mark, he is the President of the Affiliated Group, a collection agency based in Minnesota, and he is the newly appointed President of ACA. I thought he explained the federal and state environment for ARM professionals as well as anyone I ever heard cover these delicate and complicated topics. He addressed the CFPB and FTC’s role, TCPA, and FDCPA (alphabet soup if you ask me). He helped roll out the ACA new blueprint designed to modernize collections, discussed state Attorney General efforts, and addressed the media scrutiny of the industry. I think his presentation is a must-see for anyone that touches the ARM industry.

I took a different approach to covering the state of affairs of our industry by creating a list of the top reasons I believe the industry is in for a long recovery process. Over my next three blog posts, I will dive into each of the points that I covered during my presentation. Here are the first few:

The average American is feeling poorer by the week

- Nearly 50% of Americans lack a rainy day fund in which they cannot come up with $2,000 in cash in a few month period (source: National Bureau of Economic Research)

Consumer confidence levels, fueled by fuel prices and food prices increases, declined in May and again in June, with a slight uptick in July

Consumer confidence levels, fueled by fuel prices and food prices increases, declined in May and again in June, with a slight uptick in July

- Reduction in government stimulation efforts is impacting debtors’ ability to make large, up-front payments or total payoffs

Additional macro factors exist that won’t allow for a speedy recovery

- Other regions won’t be able to help the US recover sooner. Europe is in the middle of its own debt crisis. Emerging markets like China are slamming their growth brakes.

- The US Postal Service says it will be insolvent by the end of 2011 without a bailout. It is on track to lose $6 billion this year

- Severe weather and flooding in the southeast and Midwest has impacted recovery efforts

- Wrangling over the budget in Washington could stifle the economy for years to come

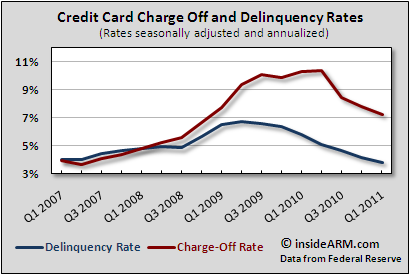

The ongoing reduction in placement volumes driven by the continued decline in credit card delinquencies and charge off rates

- Delinquency rates in Q1 2011 down 10% quarter over quarter and nearly 33% year over year, reaching levels not seen in almost 15 years, according to TransUnion

- Consumers continue to deleverage and lenders are still conservative in how they are extending new credit

- Credit card issuers and debt buyers have consolidated their collection agency vendor networks 20-60% over the past 18 months

There is some good news that will help to improve recovery efforts

- Consumer bankruptcy filings decreased 7% nationwide comparing April 2011 to one year earlier, according to the ABI

- History says that when the economy is weak it will continue to grow unless something big comes along to upset it

- The fed appears committed to keeping interest rates low

- It is very unlikely we will see a significant further decline in home prices. The real question is when will we start to see sustainable increases?

- Home sales have increased 6 out of the past 9 months and the number of owners in default is declining

Mike Ginsberg is President and CEO of ARM advisory firm Kaulkin Ginsberg, and can be reached by email. The firm is celebrating its 20-year anniversary in the ARM market.

Mike Ginsberg is President and CEO of ARM advisory firm Kaulkin Ginsberg, and can be reached by email. The firm is celebrating its 20-year anniversary in the ARM market.

![Photo of Mike Ginsberg [Image by creator from ]](/media/images/2017-11-mike-ginsberg.2e16d0ba.fill-500x500.png)

![the word regulation in a stylized dictionary [Image by creator from ]](/media/images/Credit_Report_Disputes.max-80x80.png)

![Cover image for New Agent Onboarding Manuals resource [Image by creator from insideARM]](/media/images/New_Agent_Onboarding_Manuals.max-80x80_3iYA1XV.png)

![[Image by creator from ]](/media/images/Finvi_Tech_Trends_Whitepaper.max-80x80.png)

![[Image by creator from ]](/media/images/Collections_Staffing_Full_Cover_Thumbnail.max-80x80.jpg)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![[Image by creator from ]](/media/images/Skit_Banner_.max-80x80.jpg)