Consumers in the U.S. took on $18.1 billion in debt in August, according to data released by the Federal Reserve late Friday. The gains were broad across all types of loans.

The Fed said that overall consumer credit outstanding increased at an annual rate of eight percent in the month.

Non-revolving debt – like that found in auto and student loans – paced the gains, adding nearly $14 billion in August, an annualized increase of nine percent. Auto sales were up in the month and August is also traditionally a heavy month for student loans as fall semesters get underway.

Revolving debt, mostly comprised of credit cards, also increased significantly for the first time all summer. Consumers added some $4.1 billion to credit card balances in August, an annualized increase of nearly six percent.

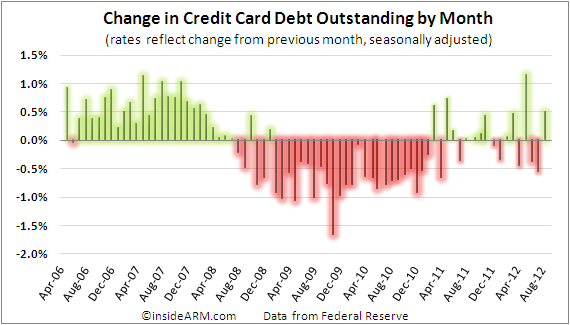

Consumer credit card debt tracking has been extremely volatile for the past 18 months, with wide month-to-month variations.

The report noted that credit card debt settled at a total of $855 billion at the end of August after a big dip in June and July. Total credit card debt outstanding has been on a long road to recovery after bottoming out in early 2011 following a precipitous decline in the wake of the financial collapse of 2008. Over that time, the credit card market lost more than $150 billion in outstanding debt as banks furiously charged-off accounts and tightened lending standards, making it harder for consumers to add to their debt.

The report noted that credit card debt settled at a total of $855 billion at the end of August after a big dip in June and July. Total credit card debt outstanding has been on a long road to recovery after bottoming out in early 2011 following a precipitous decline in the wake of the financial collapse of 2008. Over that time, the credit card market lost more than $150 billion in outstanding debt as banks furiously charged-off accounts and tightened lending standards, making it harder for consumers to add to their debt.

![[Image by creator from ]](/media/images/patrick-lunsford.2e16d0ba.fill-500x500.jpg)

![[Image by creator from ]](/media/images/Collections_Staffing_Full_Cover_Thumbnail.max-80x80.jpg)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![[Image by creator from ]](/media/images/Skit_Banner_.max-80x80.jpg)

![Whitepaper cover reads: Navigating Collections Licensing: How to Reduce Financial, Legal, and Regulatory Exposure w/ Cornerstone company logo [Image by creator from ]](/media/images/Navigating_Collections_Licensing_How_to_Reduce.max-80x80.png)