In the evolving landscape of collections and loss mitigation, understanding the operational challenges and emerging trends is crucial for developing effective strategies. So, we pulsed the industry to shed light on these aspects, offering valuable insights for industry professionals.

We reached out to US-based first and third-party collectors across various product areas, including credit card, student loan, mortgage, auto, HELOC, and personal loan.

AI and Digital Present Both a Challenge and an Opportunity for Collections Leaders

Looking ahead, AI and automation are expected to have the most significant impact on the financial services industry. Findings indicate that nearly 40% of respondents see AI as a significant area of opportunity and future impact. However, it is also the most misunderstood and challenging area.

AI offers significant potential for transforming collections, but there’s a clear need for education on its current and future capabilities. Successful organizations will have a roadmap and/or a reliable guide to follow through this transition. It’ll be critical to understand what AI can and cannot do, and how to strategically employ a cautious and effective implementation.

Repayment Strategies and the Human Touch

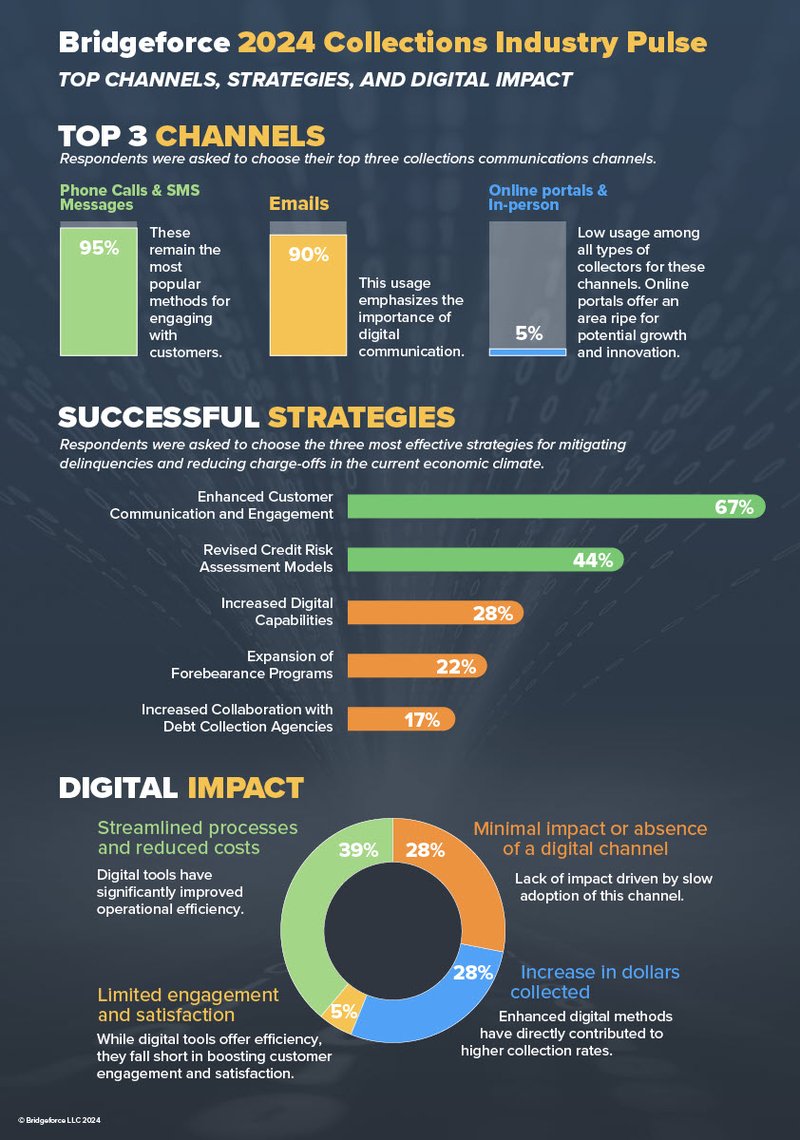

Digital portal options for repayment meet consumer preference needs and reduce costs for collections operations, as seen by nearly 40% of respondents. However, digital does not solve the larger problem of ensuring repayment commitment. The struggle remains to get people to adhere to a repayment plan. Traditional methods like letters and SMS still face the same challenges, even when digitized.

Regardless of channel, collections strategies should define how customers are segmented and how customer interaction channels are designed. Other strategic considerations include timing, messaging and the stages of collections that accounts pass through prior to charge-off. Strategic decisioning should be based on the best and most predictive internal and external data points available. Collections strategies should ebb and flow based on customer behavior and performance.

“Digital portal options for repayment meet consumer preference needs and reduce costs for collections operations, as seen by nearly 40% of respondents.”

While there is clear adoption of digitally enabled collection technologies, challenges with customer engagement persist. Respondents noted significant challenges in the use of digital tools due to low adoption rates. Customers often find it easier to disengage with automated systems than with live representatives. This underscores the continued relevance and effectiveness of a human touch in collections. Organizations who keep a focus on both digital and human intervention will require comprehensive training programs to enhance customer interactions and outcomes.

Operational Challenges Remain Unchanged

The information we’ve gathered highlights the critical challenges and trends in the collections industry, emphasizing the need for effective customer engagement, compliance, and technological adoption. With Bridgeforce’s expertise in collections and loss mitigation, organizations can better prepare for the future, leveraging advanced strategies to improve outcomes and navigate the complexities of the industry.

Regulatory Compliance: Ever Important and Consistently Shifting

Regulatory demands (state and federal) continue to be a significant burden within collections organizations, requiring constant vigilance and modifications. This vigilance is especially important as communication channels transition more to digital options. To best navigate these complexities, FIs should assess their current state of compliance and put into place frameworks and controls to remain compliant while driving efficiency and mitigating risks.

![BridgeForce Logo [Image by creator from ]](/media/images/Bridgeforce_YLlZ3uR.2e16d0ba.fill-500x500.jpg)

![the word regulation in a stylized dictionary [Image by creator from ]](/media/images/Credit_Report_Disputes.max-80x80.png)

![Cover image for New Agent Onboarding Manuals resource [Image by creator from insideARM]](/media/images/New_Agent_Onboarding_Manuals.max-80x80_3iYA1XV.png)

![[Image by creator from ]](/media/images/Finvi_Tech_Trends_Whitepaper.max-80x80.png)

![[Image by creator from ]](/media/images/Collections_Staffing_Full_Cover_Thumbnail.max-80x80.jpg)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![[Image by creator from ]](/media/images/Skit_Banner_.max-80x80.jpg)